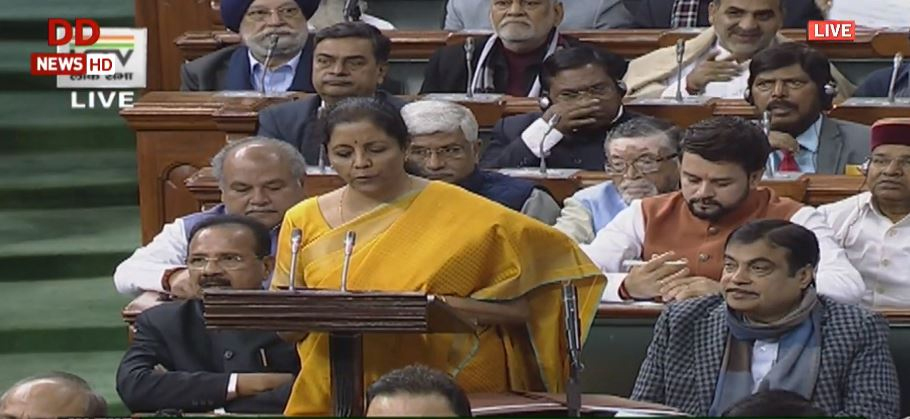

Indian Finance Minister Nirmala Sitharaman had broken her own record on the budget speech on Saturday as her speech has lasted for 2 hours and 43 minutes and it has become the longest budgetary speech ever delivered by any Indian finance ministers. Apart from being a record-setting budget on the duration, what else has it got? and will the decade's first budget make it as India's decade? Is the Budget equipped with reviving mechanisms? These have been some of the questions queued up for Sitharaman's second budget. Let's take a look at the key takeaways...

Amid the anticipations and expectations, Nirmala Sitharaman had presented the Union Budget 2020-21 at 11 am on Saturday. She started her budget speech by stating that under the leadership of Prime Minister Modi, the government is committed to present the people of India with all humility and dedication and claimed that people have reposed faith in the government's economic policy. By paying homage to former Finance Minister Arun Jaitley, who is the chief architect of Goods and Services Tax, Nirmala Sitharaman said that GST has been most historic of the structural reforms and it has been gradually getting matured into a tax that has integrated the country economically.

Nirmala Sitharaman rolled out three key themes of the Budget - Aspirational India, Economic Development, and compassionate and caring society. The major portion of her entire speech was filled with farmers and agricultural reforms. She said that the Central government's debt has come down to 48.7% in March 2019 from 52.2% in March 2014 and highlighted that the Union Government is committed to the goal of doubling farmers' income by 2022. She stated that Rs 2.83 lakh crore has been allotted for 2020-21 for agricultural, irrigation, and rural development sectors and the agricultural credit target has been set at Rs 15 lakh crore.

The government has enhanced the Swachh Bharat Mission for the fiscal year by allotting Rs 12,300 crores while the educational sector and skill development sector had been allotted with Rs 99,300 crore and Rs 3,000 crore respectively. With the view of transporting the farm goods, the Finance Minister had proposed to install new Kisan Rails through Public-Private Partnership (PPP) so that the farmers can move their goods quickly. With the motive of upgrading healthcare, the Union government has allotted Rs 69,000 crore for the healthcare sector.

As we reported earlier, the Budget has one of the largest allocations for the Infrastructure as Nirmala Sitharaman has proposed to provide Rs 1.7 lakh crores for the transport infrastructure in 2020-21 to enhance and to promote the highways, ports, and airports as the Budget has proposed to set up 100 new airports by 2024 under Udaan Scheme. This has been the first Indian Budget and indeed first for BJP after abrogating and revoking the special status from Jammu and Kashmir and through the budget, the Union government has funded Rs 30,757 crore for J&K and Rs 5,958 crore for Ladakh for the developments of newly mapped union territories whereas nation's defense is awarded Rs 1.10 lakh crore for the fiscal year. By allotting Rs 6,000 crore for Bharat Net, Sitharaman said that 1 lakh Gram Panchayats to get Optical Fiber Link and startups would be given with Digital platforms.

As predicted, the Union government had estimated a fiscal deficit of 3.85 in 2019-20 and 3.5% in 2020-21 and the government had forecasted that the nominal growth of GDP for the year 2020-21 would be at 10%. Nirmala Sitharaman has brought the major relief and relaxations to the individual taxpayers by proposing the major tax reform. By stating that the government is proposing a personal income tax regime, she announced that the income tax will be fully exempted for annual income up to Rs 5 lakh and a person earning between Rs 5-7.5 lakhs will be required to pay tax at 10% against current 20%.

Through birthing the tax reforms, the Finance Minister said that those with income between Rs 7.5-10 lakhs can pay tax at 15% against the current 20%. Those with income between Rs 10-12.5 lakhs can pay tax at 20% against 30%. The Union government has also proposed that it would sell the balance holding of the Government of India owned IDBI bank to private, retail and institutional investors through the stock exchange. Nirmala Sitharaman has cited that the holding would be sold in the view of increasing private capital and adding to that LIC is going to hit the IPO soon.

By citing that there is a shortage of qualified medical doctors - both general practitioners and specialists, the Finance Minister has proposed to attach a medical college to the district hospital in the PPP model. Besides these announcements, the Budget has no ratification on creating new employment opportunities. After the Budget, Congress leader Rahul Gandhi said that the main issue facing the nation is unemployment and stated that he didn't see any strategic idea that would help enhance the jobs and added that it may be the longest speech but had nothing in it.

Union Home Minister Amit Shah has stated that the Modi government has taken effective steps to rationalize the tax system, strengthen the banking system and boosting the infrastructure and promoting investment and claimed that the Budget would make India a $5 trillion economy.

To read the Budget thread, please visit: https://twitter.com/thenewstuffin

Also read: Will Budget 2020 remedy the deteriorating state of the Indian economy?

Comments