YES Bank - one of the largest private sector banks in India with the tagline of 'Experience our Expertise' is now been experiencing what it has neither experienced before nor imagined to come through - an unprecedented ordeal after the Reserve Bank of India (RBI) has placed the bank under the new tagline of 'financial moratorium' that beaconed the prevailing uncertainty the bank has been burdened with.

With imposing the new tagline, the RBI has also capped the deposit withdrawals at Rs 50,000 per account for a month and arrested the bank from granting or renewing any loan or advance, make any investment, incur any liability or agree to disburse any payment. In line with that, the RBI has superseded the board of Yes Bank as the bank has accounted for shrinking and weakening finances. On Thursday, the RBI has placed under moratorium and ever since it was caught up with the financial crises, the banking services of YES Bank have been plunging and causing the major dilemmas and baffles to its customers.

What could be a major reason for the sudden downfall for the bank that earlier had less than 1% of the bad loans?

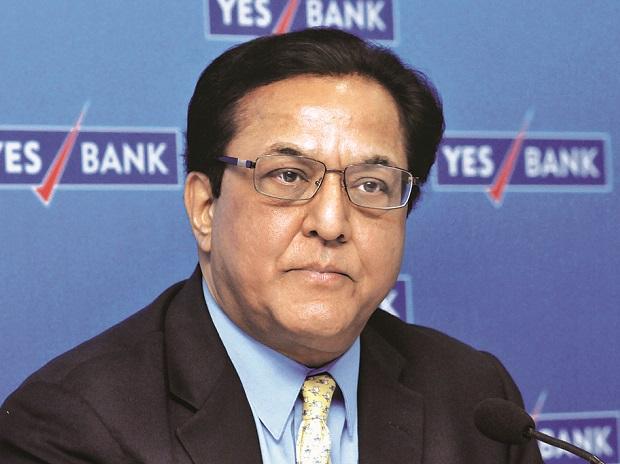

Yes Bank, which was established in 2004, currently is running through its 16th year in the banking industry. It was founded by Rana Kapoor and Ashok Kapur in 2004. Ashok Kapur took over the Chairman while Rana was placed as CEO and MD of the start-up financial institution. In 2008, Rana Kapoor came to the front foot of leading the bank after Ashok has died in the 26/11 Mumbai attacks. Within a decade, Yes Bank has shaped into one of the largest banks in India with an asset of over Rs 3 lakh crore.

According to the reports, Rana Kapoor was known to be the aggressive lender and under his leadership, YES Bank had approved to lend more to the companies when no other banks were agreed to lend and its lending policies had boomeranged with the ordeals and biggest financial problems. It has lent the loans to most of the companies that, in turn, added to its accounts of bad loans. The finances it lent has reverted with Non-Performing Assets (NPA) and the decade long growth has now been plummeting its services with severe downfall.

Some of the companies that YES Bank had lent include Cafe Coffee Day, Jet Airways, Essar Shipping, Cox and Kings, Anil Ambani's Reliance Group, DHFL, and IL&FS. In 2016, the RBI has conducted inspections on the banks with the view to make sure that no banks are reporting bad loans on their books of accounts. However, in the financial year of 2016, the YES Bank had NPAs of over Rs 4,900 crore, while the bank reported the official number of only Rs 749 crore.

Amid the blow of growing bad loans, Rana Kapoor was re-elected as CEO and MD in 2018 for the tenure of the next three years. However, in the same year, RBI has limited his term in office till January 31st, 2019. The reports say that the RBI has decided to reduce his term by concerning the huge bad loans the bank had in its accounts. The rise of bad loans downgraded the stocks. On January 9, 2020, YES Bank told the stock exchanges that Rana had no more stake in the bank at the end of December 2019. Ranveet Gill has succeeded Rana Kapoor as new MD and CEO and he took over the responsibility at the aberrant times of reviving the operations and leveraging the financial services.

However, the finances have been deteriorating making the bank plead for rescue. In Quarter 4 of FY19, the bank has recorded with the loss of Rs 1,506 crore. On Thursday, the RBI has said that it has been working with the management of YES Bank to revive the liquidity and the books of accounts. It has shown no signal of attaining the deal although YES bank claimed that it has reached out to multiple investors to reach the deal.

By citing that the bank has no concrete plan of surging its establishment and to reviving the operations, the RBI has finally approached the Central government to impose a moratorium under section 45 of the Banking Regulation Act, 1949. The Central government has named Prashant Kumar, former CFO of State Bank of India to work towards reconstructing the shattered pieces of YES Bank. The current moratorium will be in place for 30 days during which the customers may face hindrances and difficulties over withdrawing the deposits.

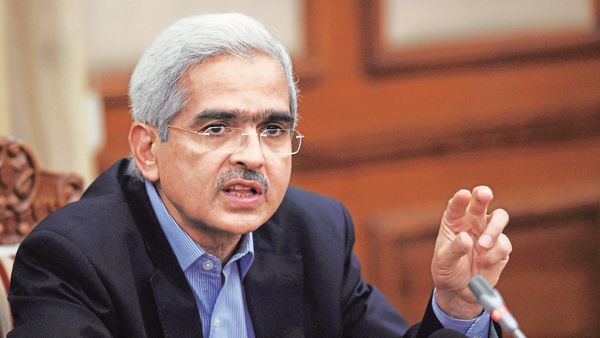

With this moratorium that will be in place till April 3, 2020, the customers of the YES Bank are entitled to withdraw a maximum of Rs 50,000 during this period from their savings, current, or any other accounts. However, the RBI has said that the customers can withdraw up to Rs 5 lakh in the case of medical emergencies, higher education, or marriage. The Central government has appealed the customers not to get panic and while addressing the reporters after ASSOCHAM's 15th annual banking summit, RBI Governor Shaktikanta Das has on Friday asserted that the swift resolution will be taken to resort the normalcy. He said that the move has been taken to ensure the safety of the financial system.

Some of the experts have quoted that RBI will not leave YES Bank to get into bankruptcy and the government will largely concentrate on merging the YES Bank with another nationalized bank. The recent reports have stated that the State Bank of India has been exploring investment opportunities to invest in the YES Bank. While, on one hand, the customers are reported with lack of banking services from YES Bank, on the other hand, Congress leader Rahul Gandhi levied the blame on Modi government. He has tweeted that " No Yes Bank. Modi and his ideas have destroyed India’s economy".

Comments