The sudden plunge, unprecedented ordeal, plummeting of services and RBI's new tagline of 'financial moratorium' have jointly written the conclusion for the YES Bank's chapter as then one of the top private sector banks has now leaping on the verge of bankruptcy - not because of the various establishments but because of the soaring high bad loans and the increase in the Non-Performing Assets (NPAs), and certainly, the bank's attitude of lending more to the companies that were collapsing.

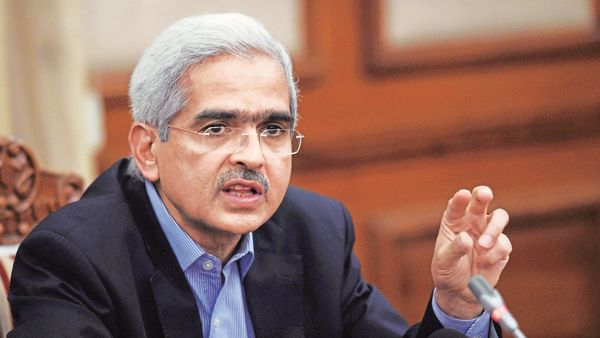

Days after the Reserve Bank of India (RBI) has placed YES Bank under a financial moratorium for a month and arresting its banking services, the Enforcement Directorate (ED) has detained Rana Kapoor, the co-founder of YES Bank, under the grounds of racket and illegal exchanges. The ED has taken him to custody. For the past few years, YES Bank has been on the brink of getting collapsed due to administrative disorders, corruption, rackets, and bad loans and last year, RBI Governor Shaktikanta Das took YES Bank under the direct control of the RBI and he formed a committee to overview and to operate YES Bank following which the committee had exhumed the earthed irregularities of Rana Kapoor.

RBI has lodged a complaint against Rana Kapoor in CBI and ED. Based on the complaint, the investigative agencies had raided the properties belong to the Kapoor family during which they recovered the documents of the fake companies. Some of the documents revealed that Rana's wife and his daughters were operating more than thirty companies by screening its presence and about Rs 2,200 crore had been illegally exchanged through these fake companies. Rana Kapoor has provided Rs 3,700 crore loan to Dewan Housing Finance Corporation (DHFL) and for acquiring the loan of Rs 3,700 crore, DHFL had bribed Rs 600 crore to Rana Kapoor and along with that, Rana Kapoor has provided loans of Rs 10,200 crore to the companies like Cafe Coffee Day, Jet Airways, Essar Shipping, Cox and Kings, Anil Ambani's Reliance Group, DHFL, and IL&FS and he provided loans despite knowing that some of the companies will become bankruptcy.

Some of the members of All India Bank Employees Federation said that the RBI is also been one of the reasons for the disorders in the YES Bank as after realizing that YES Bank's situation, the RBI has suddenly taken over the control and imposed several restrictions to YES Bank's customers from withdrawing their deposits from the bank and RBI has asked Central government undertaking LIC and SBI to buy YES Bank's shares that might become more dangerous. When we reached out to the employees of the State Bank of India, they say that the RBI has superseded the board of Yes Bank and the Governor has been acting based on the directive from the Union Finance Ministry and the RBI has now been carrying out the process to recover Rana's properties in asserts that he had in foreign countries and to seize the properties of the companies that accounted for bad loans.

After Modi came to power, an institute in Bangalore has conducted a survey on the state of Indian Banks in 2017 and in its study, it stated that the scandals and disorders have been getting increased in the Public sector banks and when we asked the experts and economists, they divulge that after Punjab National Bank reported with the scandal of Rs 11,000 crore in which Nirav Modi was involved, the state of Indian Banks has been deteriorating and in 2014, there were rackets of Rs 700 crore that were committed in the fixed deposits handled by the Public sector banks and there were nine cases registered against the scandals but no concrete conclusion was seen.

In the same year, Kolkata businessman Bipin Vohra has fled the country after acquiring a loan of Rs 1,400 crore from Central Bank of India through moving the fake documents. Similarly, Syndicate bank's Managing Director Jain had faced interrogations for providing an 8,000 crore loan in return for the bribe. In 2015, it came to the revelation that about Rs 6,000 crore had illegally exchanged to the fake companies in the other countries through Indian Banks and although the case came to the spotlight, no arrests were made. In 2016, the horde had opened more than 300 fake bank accounts in Syndicate Bank and looted Rs 1000 crore with the help of the bank employees. Again, in 2016, businessman Vijay Mallya had fled the country after failing to repay the loan of Rs 9,000 crore he bought in Punjab National Bank, State Bank of India, and Union Bank of India.

Following Mallya, Nirav Modi took the flight and left the country by having a bad loan of Rs 11,300 crore and these are the cases that hold a testament about the rise of bad loans in the past six years and despite CBI has filed several cases, it has in no way contributed to decreasing the crime as these cases have been filed for eyewash and the audits and Ministry of Finance are not paying keen attention to the bank's quarterly reports that carry the total bad loans. RBI has admitted that the disorders and scandals in the banks had increased by 4% after 2014. In 2014-15, the bank frauds had stood at Rs 19,455 crore while for the year of 2018-2019 it rose to Rs 95,760 crore and the Modi government has seemingly been failing to install the mechanisms to contain the frauds that had led the Indian economy to deep plunge. Although Finance Minister Nirmala Sitharaman proclaims that the deposits of people are safe in the banks, the current state of Indian banks is causing baffles and losing its belief from the common people.

Also read: YES Bank crisis: What was the reason for the sudden plunge and what's next?

Comments